Introduction to the shift towards online accounting businesses

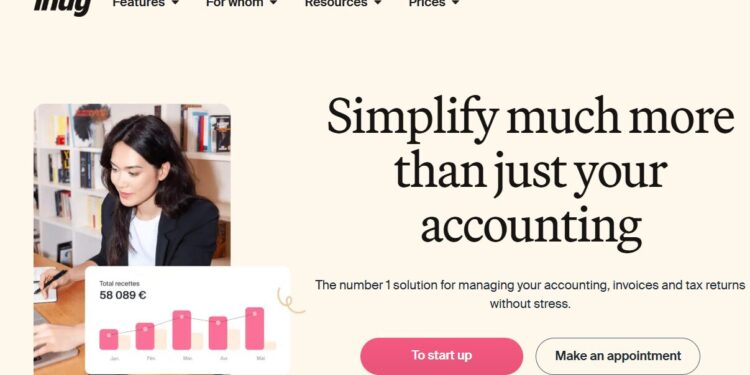

The world of accounting is transforming, and it’s hard to miss the shift towards online services. Gone are the days when you had to sit across a desk from your accountant with stacks of paperwork. Today, independent online accounting businesses are changing the game—and for good reason.

Imagine having access to financial expertise at your fingertips, all while enjoying flexibility and convenience like never before. With technology paving the way for innovation in this field, clients can now manage their finances more efficiently than ever. This rise isn’t just about staying current; it’s about unlocking new levels of financial clarity that empower individuals and businesses alike.

Curious how these Indy online accounting firms are making waves? Let’s dive deeper into why they’re becoming a go-to choice for many seeking smarter financial solutions.

In today’s fast-paced world, the landscape of accounting is undergoing a significant transformation. Gone are the days when financial management meant endless stacks of paperwork and long meetings with accountants in stuffy offices. The rise of online accounting businesses is reshaping how individuals and small businesses handle their finances.

As technology advances, we’re witnessing a shift that prioritizes convenience, accessibility, and clarity. Whether you’re a freelance creative or a bustling entrepreneur, navigating your finances can now be as easy as clicking a button. This evolution not only simplifies processes but also brings an array of tools designed to enhance financial insight.

Join us on this journey into the realm where traditional meets digital—where numbers become manageable and financial clarity is just around the corner. Let’s explore how Indy online accounting services are leading this charge and what it means for your fiscal future.

Benefits of using an independent online accounting business

Choosing an independent online accounting business offers personalized service that larger firms often can’t match. You’re not just another number; your unique needs are prioritized.

Flexibility is another key benefit. With remote access, you can connect with your accountant anytime, anywhere. This adaptability allows for real-time updates and insights into your financial situation.

Cost-effectiveness also plays a significant role. Many indie accountants provide competitive pricing without compromising quality, helping you save money while receiving expert services.

Additionally, communication tends to be more direct and transparent in smaller setups. You’re likely to build a trusted relationship over time as the focus remains on your specific goals and challenges.

These businesses often utilize innovative tools tailored to your industry’s specifics, enhancing efficiency and accuracy in managing finances.

The role of technology in the growth of these businesses

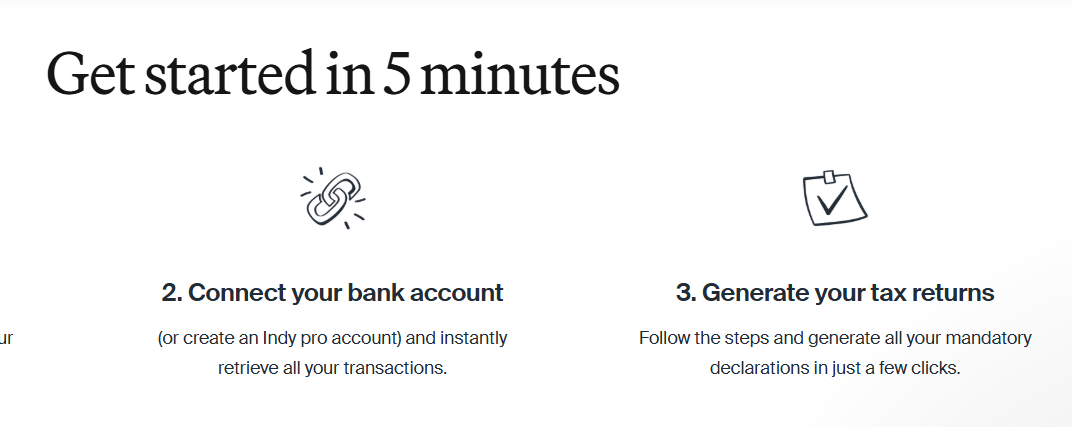

Technology has been a game changer for the accounting industry. With cloud-based solutions, businesses can access their financial data anytime, anywhere. This flexibility empowers both clients and accountants to work collaboratively in real-time.

Automation tools streamline tedious tasks like data entry and invoicing. By reducing manual processes, firms can focus more on strategy rather than just crunching numbers.

Advanced analytics provide deeper insights into financial health. Clients benefit from tailored advice based on precise data interpretations, leading to informed decision-making.

Secure communication platforms ensure that sensitive information remains protected while allowing seamless interactions between clients and accountants. This builds trust and enhances reliability.

The rise of mobile applications further simplifies accessing financial records on the go. Whether it’s checking cash flow or approving expenses, technology makes managing finances easier than ever before.

Potential challenges and how they can be overcome

Every new venture comes with its set of challenges, and online accounting is no exception. One significant hurdle is building trust with clients. Unlike traditional firms, independent online accountants often lack the physical presence that fosters confidence.

To overcome this, transparency becomes vital. Offering clear service descriptions and showcasing client testimonials can bridge the gap. A strong digital footprint—through a professional website or active social media profiles—also helps in establishing credibility.

Another challenge lies in adapting to rapidly evolving technology. Tools and software can become outdated quickly, leaving some businesses scrambling to keep up.

Regular training sessions for staff are essential here. Keeping abreast of industry trends ensures that services remain relevant and effective.

Data security concerns loom large for many clients hesitant about sharing sensitive information online. Implementing robust cybersecurity measures not only protects client data but also reassures them that their finances are safe in capable hands.

Conclusion: Embracing the future of financial clarity with Indy online

Embracing the future of financial clarity with Indy online accounting services opens a world of opportunities for businesses and individuals alike. The convenience of accessing expert financial guidance from anywhere, at any time, transforms how we manage our finances. As technology continues to evolve, so does the potential for innovation in this field.

Independent online accounting firms provide personalized attention that larger companies often overlook. They focus on building strong relationships with clients while leveraging advanced tools to streamline processes. This marriage of personal touch and technological efficiency makes it easier than ever to make informed decisions.

While challenges may arise—such as navigating new software or understanding digital privacy—it’s essential to approach these hurdles with an open mind. Continuous learning and adaptation are part of the journey toward greater financial clarity.

The rise of Indy online accounting is more than just a trend; it’s a transformation in how we think about finance management. By embracing this shift, you position yourself at the forefront of a clearer, more organized financial future.